Why Invest in Farmland

- lesliemcmullin

- Jan 31, 2023

- 3 min read

Updated: Feb 15, 2023

Farmland has a straightforward investment thesis that hasn’t been straightforward to invest in.

As a trillion dollar asset class with a long history of building wealth for generations, investments in farmland can add diversity to your portfolio with historically strong and low-volatile appreciation trends.

Here are the main components of the farmland investment thesis:

1. The availability of high quality farmland is declining every day:

Food demand is up and the supply of productive land, both in the U.S. and globally, is down, creating a supply - demand imbalance that we believe will persist and create long-term value in the asset class

2. Farmland has historically strong performance:

Farmland has increased 6% on average every year since 1940, moving in-line with the S&P with less volatility

Farmland investments are backed by a real asset with tangible value growth

3. During past recessions and periods of high inflation, farmland has enabled diversification:

Farmland can act as a hedge against inflation, as values have historically increased with inflation while showing low volatility relative to the market overall

With little correlation to stocks and bonds, including through past recessions, farmland can help to diversify your overall portfolio strategy (for example, farmland increased 12% in 2022 per the USDA, while the S&P declined 19%)

Farmland Capital by FBN is here because farmland carries a straightforward investment thesis that hasn’t been straightforward to invest in. Our thoughtful structure enables investment alongside farmers, creating shared incentives to build value together. Farmers continue to operate and invest in what they know best – their land – which creates opportunities for above market returns in the farmland asset class.

We aim to keep you updated on developments in the farmland asset class as you develop your investment thesis. Check out our latest news here.

1. Declining supply of high quality land

US farmers are responsible for feeding the world, and the high quality land on which that production relies, is decreasing every day. In the meantime, growing, ageing populations and wealthier consumers need more calories from that decreasing base of production.

Farmland Capital gives you access to some of the highest quality farmland possible, through our network of FBN member farmers. We believe the supply of high quality land is decreasing the fastest, and will be most in demand as time goes on.

2. Historically strong appreciation

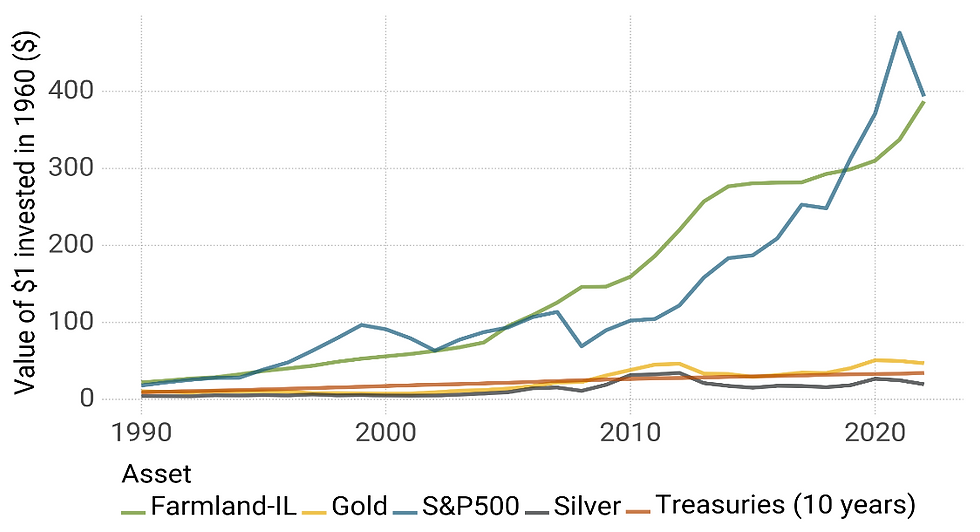

Farmland has held its value through all four of the most recent recessions, and appreciated at rates in-line with the S&P with less volatility.

Data from USDA (Farmland-IL), longtermtrends.net (Gold and SIlver), FRED St Louis (Treasuries), and Robert Shiller (S&P500).

All returns assume reinvestment of dividends

3. Portfolio diversification tool

In times of uncertainty, farmland can be a valuable tool to diversify your portfolio from traditional stock and bond investments, given its low correlation to these asset classes.

Sources:

Bonds: Moody's Seasoned Baa Corporate Bond Yield; S&P 500: S&P 500 index including dividends; Residential = 1940-1953 Five-CityMedian, 1953-1974 PHCPI, 1975-2019 S&P/CoreLogic/Case-Shiller; Commercial: FRED Commercial Real Estate Price Index; Farmland: USDA. Includes buildings and land

At FBN, we believe in farmland’s strong fundamentals:

an increasing demand for food as the available supply of land continues to decline,

strong historical appreciation, and

strength as a portfolio diversification tool

The growth in this asset class has created larger barriers to entry for new and veteran farmers to build their businesses, and underscores the importance of financing alternatives to help farmers buy land. Accredited investors like you are important to fulfilling our mission.

Looking for the best Naraina Escort there is? You've come to the right place. Our agency is overflowing with new girls ready to give an exciting and sensual experience. Guaranteed satisfaction and discretion.

The competitive gameplay in Paper io makes it one of the best .io games out there! Every match feels different, and the thrill of dominating the map is amazing.

Snow Rider 3D is an exciting, fast-paced skiing game that delivers a thrilling winter sports experience.